How does it work?

The federal government allows homeowners to accrue equity in their primary residence tax-free up to a certain amount: $250,000 if single, $500,000 if married. Keep your home beyond these limits and you’ll be paying more in taxes when you sell. Selling when you reach those limits and transitioning to a new primary residence allows you to accrue more wealth tax-free.

Who should use the TooMuchEquity method?

Those that want to grow their wealth through real estate and pay less in taxes while doing it.

The TME method over time

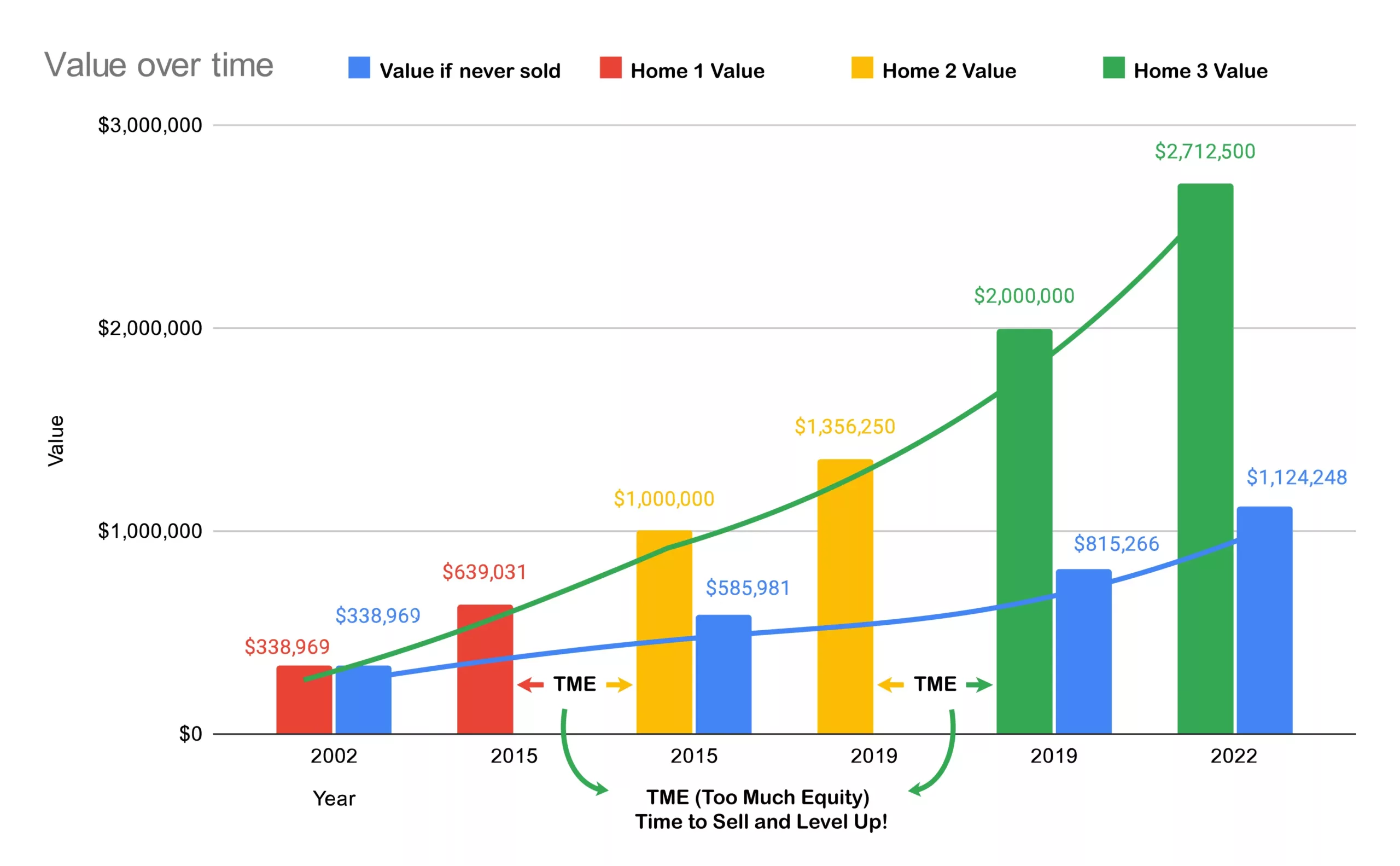

Below is a visual of how the TooMuchEquity method works if you were to sell your home each time you near your capital gains limits.

If a homeowner follows the TME method by selling when they reach their capital gains limit, they will dramatically increase their equity and lower their tax basis with each new home purchase compared to a homeowner who does not sell their home.

Is it time to sell?

As the housing market has changed, affordability and interest rates have become a barrier to entry, and market uncertainty has caused more homeowners to hang on to real estate for longer. The question of how to maximize equity to reach your financial goals has become more important than ever. Our team of industry experts can help you get the most out of the equity in your home. Don’t let the equity in your home become a liability to your other financial holdings. Fill out the simple form below and we will help you see the full picture when it comes to the equity in your home.

Do you have TooMuchEquity?

Find out now!

What we do

At TooMuchEquity.com we help homeowners identify the perfect time to sell based on their entire financial picture, not just their real estate holdings. Learn more about identifying the perfect time to sell your home by filling out the convenient form above.

If you would like to speak with one of our industry experts on knowing exactly when to sell your real estate holdings to maximize profits please get in touch with us today by calling 425-409-9352.